SMSF ESA providers provide SMSFs with an electronic service address (ESA) to allow them to use the SuperStream electronic transfer system for payments and messaging.

SuperStream is part of a move towards standardisation and digitalisation of information and payments for superannuation and retirement savings.

Since 2014, businesses have used the system to pay superannuation guarantee (SG) contributions to super funds and inform SMSFs that they have done so.

The range of transactions that must be processed through the SuperStream system was extended in 2021, which is why SMSF messaging service providers are in the news.

While this introduction may seem simple enough, some terms may need explanation.

They include

SuperStream arises out of the Superannuation Legislation Amendment (Stronger Super) Act 2012, a complementary regulation in December 2012, and some supplementary amendments.

These instruments outline the standards for processing super contributions and rollovers. There are two sets of standards:

The standards set out what information must be provided in all notifications (for example, a fund’s Australian Business Number (ABN) and a unique reference for each payment) and what the performance standards are. For example, rollover of funds must be completed within 3 days of the paying fund receiving all the correct information.

You may see a request for a USI number. This is the Unique Superannuation Identifier Number and applies only to APRA-regulated funds. SMSFs use their ABN.

There are standards for the electronic transmission of information and payments on the Superannuation Transactions Network (STN). This is a closed network for employers, superannuation funds, and the Australian Taxation Office (ATO).

One standard refers to the need for operators on the network to verify the details of both senders and recipients of messages before they pass them on.

The STN is a system of integrated gateways (like linked post offices). Each one has an “operator”- these can be banks, small businesses, or fintechs. Their job is to route, switch, and package data messages between employers, funds, and the ATO, in a reliable and secure manner.

Each gateway has an “address” so that you can find them. It is an alphanumeric string of letters – for example, AUSPOSTSMSF. This is like a URL or IP address to find a website or your computer for your email.

Operators provide this electronic service address (ESA) to people who want to use their services.

There are two types of operators. Those whose services are available to anyone who wants to register with them, and those who restrict their services. For example, a bank may facilitate transactions only for funds or employers who are clients of the bank.

Some of those in the second group are not operators on the main network. Instead, they are linked to an operator via an API (the application to link one computer service with another).

The Tax Office maintains a register of providers. Their purpose is enabling regulated superannuation entities to comply with regulations.

You can select an ESA service provider linked to a gateway. They will register your details on their system and provide their address to you. Their address becomes your ESA.

You give your service provider’s details to whoever needs to know – the ATO, employers, other super funds – and they will direct notifications to your “mailbox” there.

You can register directly, or SMSF administrators, tax agents, accountants and some banks can do this on your behalf.

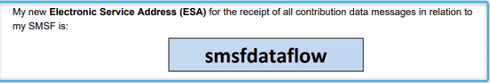

So, for example, SMSF Engine uses administration software systems provided by BGL and Class. Both are registered SMSF messaging providers. This means that our clients who are linked to one of them can use their ESAs – BGLSF360 or smsfdataflow – as part of the administration service.

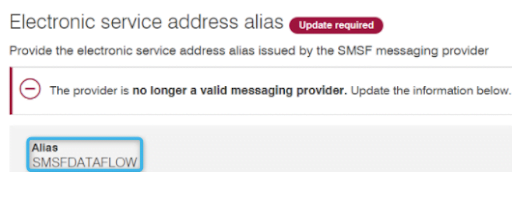

Please note that an ESA is case sensitive. Here is the response returned when someone used upper case for smsfdataflow:

Changes from October 2021 affected fund rollovers and release authorities.

The legislation issued in 2013 anticipated that rollovers would be part of the SuperStream system. In October 2021, it became mandatory.

SMSF administrators can now use SuperStream to initiate rollovers on behalf of their SMSF clients.

The ATO may designate SMSFs as non-complying if they have seriously contravened super laws or regulations. These SMSFs have a problem, as funds cannot be rolled to or from non-complying funds.

Funds do not have to use SuperStream in certain circumstances, where other processes can be used. These include

The messaging provider doesn’t initiate a physical transfer of money. Funds make payment via EFT and use the payment reference number in the electronic proof of payment message.

A release authority is a document from the ATO, authorising the release of a member’s superannuation for a specific purpose, usually to settle a tax liability.

The ATO can now provide the following authorities electronically:

If your self-managed super fund has been receiving SuperStream data on employer contributions, you already have an electronic service address and are familiar with the system.

However, not all SMSF messaging providers have updated their systems to accommodate rollovers and release authorities.

If yours hasn’t, and you need these additional services, you will have to move to a new messaging provider.

You can’t have more than one electronic service address. So you will have to cancel your current service provider to get a new one. Remember to inform the ATO and member employers of any changes in your electronic service address.

You may not need an ESA. However, you might want to seek professional advice to make sure.

Here are some examples, taken from the ATO website:

Example 1

You have a family business.

Example 2

You want to release excess contributions from your self-managed super fund and have made the application via the ATO online system.

SMSF ESA providers ensure that SMSFs and employers are linked to the Superannuation Transactions Network. Payments and associated data can be communicated electronically and according to consistent SuperStream standards.

Employer contributions to super and rollovers between funds must be processed via SuperStream. Some release authorities from the ATO can also be communicated electronically, thus speeding up processes and the release of funds.

Some SMSF ESA providers haven’t yet updated their systems to accommodate rollovers and release authorities, and SMSFs may have to find a new SMSF messaging provider.

We offer a comprehensive and friendly Daily administration service for SMSF accountants and financial advisers and for SMSF trustees.

It includes linking your SMSFs to an SMSF messaging provider and providing them with an ESA.

For more information, please speak with Mark Phillips or Alex Polorotoff at 1300 364 597 or email at mark.phillips@interprac.com.au or alex.polorotoff@smsfengine.com.au.

When planning for the difficult event of an SMSF member becoming incapacitated, there are a number of considerations. One of […]

Can you follow the ATO’s SMSF tax return instructions and submit your own SMSF annual return? The answer depends on […]

Keep up to date with all the latest SMSF news and updates by subscribing to SMSF Engine’s newsletter.